Music press is biased. Financials are not. Digging into Warner Music’s recent performance.

In the “real” world, when analysts or investors look to examine the state of an industry, they often start with an assessment of the performance of the major players — using them as the bellwether. In the music industry, people seemingly receive their facts from tabloid news about Ms. Swift and Radiohead.

Warner Music Group — one of the three largest music copyright owners, music promoters, and music investors rolled into one — files quarterly statements with detailed financial insight on their various divisions. They offer the most disclosure of the 3 major labels and thus there’s no excuse to ignore the facts.

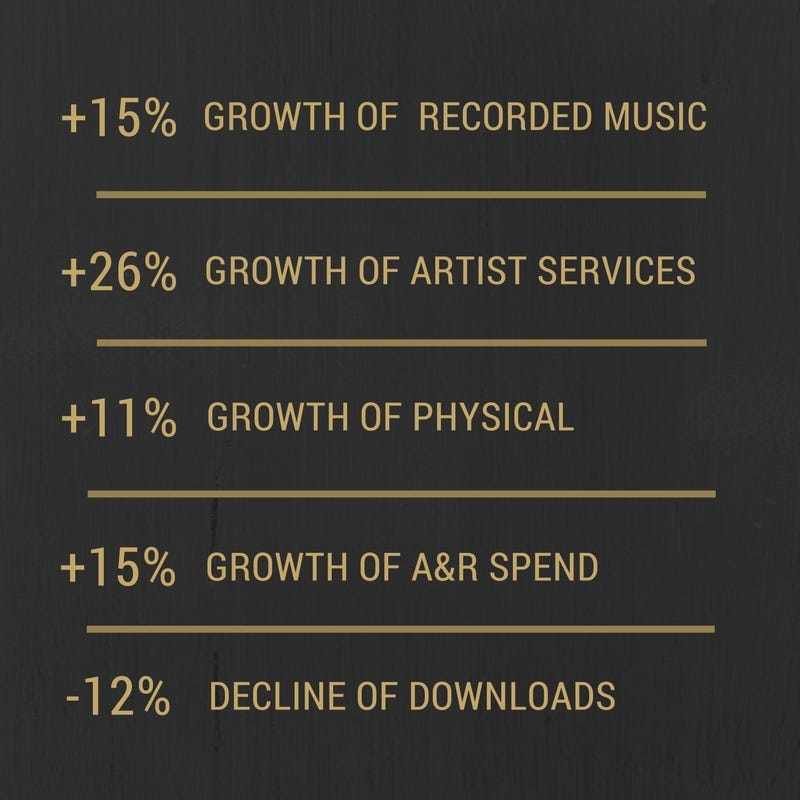

We track this closely at LIVAMP Funding since industry growth is so important to understand for anyone investing in artists through our platform. Warner's last quarter, announced a few days ago, was a continuation of the trend they've seen and it’s pretty stunning. Here are 5 numbers that caught our attention:

Source: Warner Music Group 10Q Filing for Quarter Ending Jun 30 2016

Let’s take a closer look at what’s going on at a few of these.

15% Growth of Recorded Music

Yes, this is all of recorded music including downloads and physical. You know, the same subject matter that journalists love to make Trump-esque headlines about:

(The Atlantic)

Within Recorded Music sit a few different revenue streams, but the biggest by far are Digital formats and Physical formats. Here’s a closer look at the composition of this segment and their relative growth rates:

When streaming (+45%) and downloads (-12%) are shaken and stirred together, they result in a 19% growth rate for digital revenues. Think about that — that’s revenues flowing to copyright holders: not streams, views, clicks or social media followers. That’s an average Warner Music Group album that didn’t exist 365 days ago and then got put on digital platforms for paid consumption. Let's give you some more context — Twitter grew revenues 20% in the same time period. Is Twitter dead?

15% Growth of A&R Spend

A&R is a sexy term thrown around at music conferences, but as a financial expense line it comprises three things:

1) Royalties to artists/songwriters/producers/etc

2) Cost of artist development

3) Cost of music production in the studio

The first one is a straightforward variable cost. Label owns X% of an artist’s rights so for every $1 of income, they pay get $1*(1-X) to the artist.

#2 and #3 are true investment dollars in artists. So let's put a slightly sensationalist spin on it: the big boys of the industry are growing their risk-taking by 15% this year. Think they may have a closer ear to the ground than whatever blog wrote about Taylor Swift keeping her music off Spotify?

26% Growth of Artist Services/Expanded Rights

This division encompasses Warner’s participation in non-traditional rights such as concert promotion, sponsorships, as well as services offered to artists on a commercial basis (vs. on an investment basis). This is an exciting story — more and more artists are looking to maintain more of their traditional music rights/creative control but still need to put together a holistic team to help them properly promote and monetize their overall brand. This business is clearly benefitting from this trend.

11% Growth of Physical

Alright, this one is hard to extrapolate too much — they had an insanely successful release of a popular French artist’s album (Renaud). But even looking back to a quarter before, physical sales were pretty much flat when you take out currency swings. Europe is a big driver here — in many countries, CD and vinyl sales still represent ~60% of all music income. Remember, Spotify and Deezer are both streaming giants that have come from Europe so it’s hard to make the standard European tech argument that “they’re just a few years behind the US in their conversion”. We’d expect this to be a much more gradual transition into digital than many expect.

-12% Decline in Downloads

This is obviously the sore point. Downloads are still ~18% of recorded music (and ~22% at Universal) which is not an insignificant number. But let’s draw a conclusion that may be even more relevant to younger artists just starting out and making the decision of how to distribute and promote their music. In a world of short attention spans, would you rather show a 12% decline in the income of your product or 45% growth?

What we don’t know

- How was growth distributed between newer artists and established catalog. e.g. we know that Lukas Graham’s debut US release was a big driver this quarter, but how much of the streaming growth was also impacted by Ed Sheeran’s continued success?

- Was A&R investment concentrated on existing artists or new acts?

- How big of an impact of Warner’s strong performance relative to competitors was related to the timing of new releases?

Did we miss anything? Reach out at info@livamp.com and subscribe below for more