LIVAMP Funding: How Does It Work?

The Basics

The LIVAMP Funding platform (www.livamp.com/funding) makes it easy to offer a percentage of artists' rights in exchange for funding for specific projects. Artists/managers/labels post their proposals and provide supporting information, while individual investors and investment funds review the opportunities and make offers.

Rights may include a stake in future revenue from live performances, recorded music, merchandising, publishing, or brand sponsorships and advertising. Artists can offer one specific type of right, all of them, or some combination in between - different careers require different structures.

Investment through LIVAMP is always allocated to specific projects. Examples of common projects are tour support, marketing/promotion campaigns, and production.

Deals range from tens of thousands to millions, but on average, we find a developing artist with strong credentials and track record is able to raise ~$30-50,000 in exchange for ~20% of some combination of rights.

"Will This Work For Me?"

Believe it or not, investing is also an art and not a science. Some investors are drawn to numbers, while others focus on the team involved. Here’s a simple breakdown of just some of the most common elements investors ask about:

- History of past success: Have you generated revenue already through your work or performances? Was your single charting on Hype Machine or featured in a bunch of top Spotify playlists throughout 2016? Have you been on tour beyond small local venues in your home town? Have you had press coverage or had your music licensed for a TV show?

- Upcoming milestones: Have you been speaking to a booking agent that wants to book you for tour opening slots? Is CAA on board as long as you have tour support? Is a label interested in releasing your next album? Do you have a brand endorsement deal lined up which will pay out over time?

- The team: who is your management? Is an indie label on board? Do you have a specific agency for marketing/PR in mind? Who will book your tour?

Talent: Last, but certainly not least - does your music engage audiences?

"How do I get started?"

Registering a new deal is a piece of cake, but beyond that, we want to give you as many tools as possible to best paint the story of your investment. Below is a rundown of how to get started along with a basic overview of some of our platform's features that let you differentiate your story from the crowd.

Log onto livamp.com with Facebook, Google, or a custom User ID and password. If you’re an artist, register yourself as an artist. If you’re a manager, chose ‘manager or label’ from the drop down list at sign in. Once you’re logged in, head over to your funding dashboard. Here you’ll be able to create your deal.

You should have an idea of the following before you launch a deal:

- How much money you’re looking to raise

- What you’re spending it on

- A rough estimate of next year's revenue

- What rights you’re willing to offer

- Which works you’d be willing to give up recording and publishing rights on (if you’re offering those)

- An estimate of what percentage you’d like to offer up

- And whether or not you'd be willing to offer investors the ability to first recoup their investment (a structure that incentivizes investors, but may not work for all artists)

Once you launch your deal, you can always go back in and edit the terms or the amount you’re looking for. From there, let’s move onto some important tools which help us better understand your opportunity. These "diligence" tools include your business plan, diligence questionnaire and your story builder. Artists that take their time to go through these in a thoughtful manner instantly stand out.

1. Business Plan

The most important tool in this arsenal is your business plan - you can always find it in the Diligence Tools section of the funding dashboard.

The business plan lets you paint a vision of where you see your revenue going over the next five years under reasonable assumptions:

Once you enter values for the preliminary questions, the tool enables you to adjust the basic assumptions for the next five years. Pro tip: make sure to play with these values. Our model leaves the amounts the same for years 1-5, so it’s your job to paint a more accurate (and convincing) storyline.

You should be filling out these values assuming that you will continue to grow and work hard while also erring on the conservative side. Be reasonable and put yourself in the shoes of the investor: going from $1,000 to $100,000 in one year may happen, but forecasting that without substantiation will make you appear not very serious.

We’ll be asking you where you see your income going across these revenue sources:

- Club shows (think: shows where you’ll get a percentage of ticket sales)

- Larger shows (think: shows where you may get a minimum guarantee or a flat fee: e.g. a festival or tour opening slot)

- Recorded music (album sales and streaming...remember, it's 2017...)

- Licensing (synch)

- Sponsorships

- Merchandise

Once you go through the main revenue streams, you’ll be taken to a summary of your five years and what your return to investors will be at the basic deal terms. Investors typically look to make at least 2-3x their investment over 5 years under defensible assumptions. If you believe in your business plan, but are below that benchmark, consider asking for less capital or offering a higher percentage on your rights.

2. Annotating Your Business Plan

Once your business plan is set, a nice way to add more color to the numbers is by annotating it. We've integrated the tools from our friends at Genius to let you walk investors through your thinking.

Do you have something almost certainly in the works that’s hiking year 1 number up? Don’t leave it to us to infer what that something might be - annotate it and lay down the cold hard facts. Investors love a juicy storyline with evidence to substantiate it.

To use the annotation tool, make sure you have marked the business plan Public (switch at the top right corner) and follow the "Annotate Plan" link. This will show you how investors see your plan.

Highlight the number you'd like to annotate and then press the 'annotate' pop up.

A panel will appear on the righthand side of the page where you can type up the note and Save it. That's it!

Annotated numbers will now clearly show up highlighted upon review:

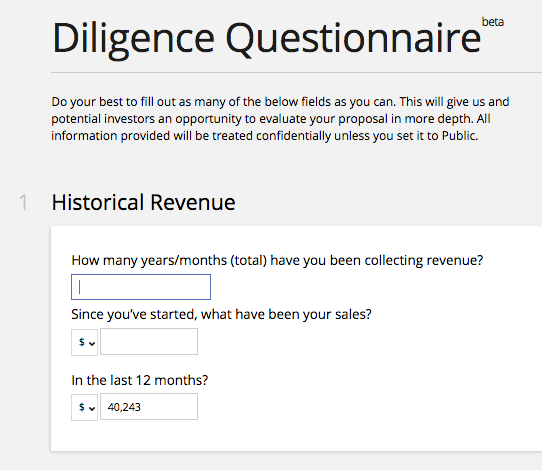

3. Diligence Questionnaire

The diligence questionnaire is a central place to provide and verify the basics about your commercial career.

Be detailed with your answers but to the point. Here’s a breakdown of the information we’ll be asking you here:

- Historical revenue (since you’ve been a musician as well as in the last 12 months)

- Are there clear catalysts for generating revenue over the next 12-18 months. If the answer is yes, we’ll ask you for more details on what the opportunity is.

- The team - it takes a village to raise a child and it takes even more than that to launch a successful music career. We want to know who’s in your corner.

- Upcoming milestones - new album cycle? New marketing campaign? What’s going to drive your work?

- Press - any notable press coverage invesors should familiarize themselves with?

- Streaming - what are your streaming numbers looking like and on which platform?

This questionnaire further enables us and potential investors to differentiate between opportunities. It's most certainly ok if you're just getting started and haven't generated any revenue yet - but this will likely drive the terms you can get from potential investors relative to someone who has been touring for 5 years.

If you feel like there’s something we’re missing which further substantiates your proposal, you can always reach out via email (info@livamp.com) to get your message across in addition to filling out the form.

Pro tip: Be as thoughtful as possible with your business plan and diligence questionnaire. This is what we pay most attention to when analyzing opportunities on the platform.

4. Story Builder

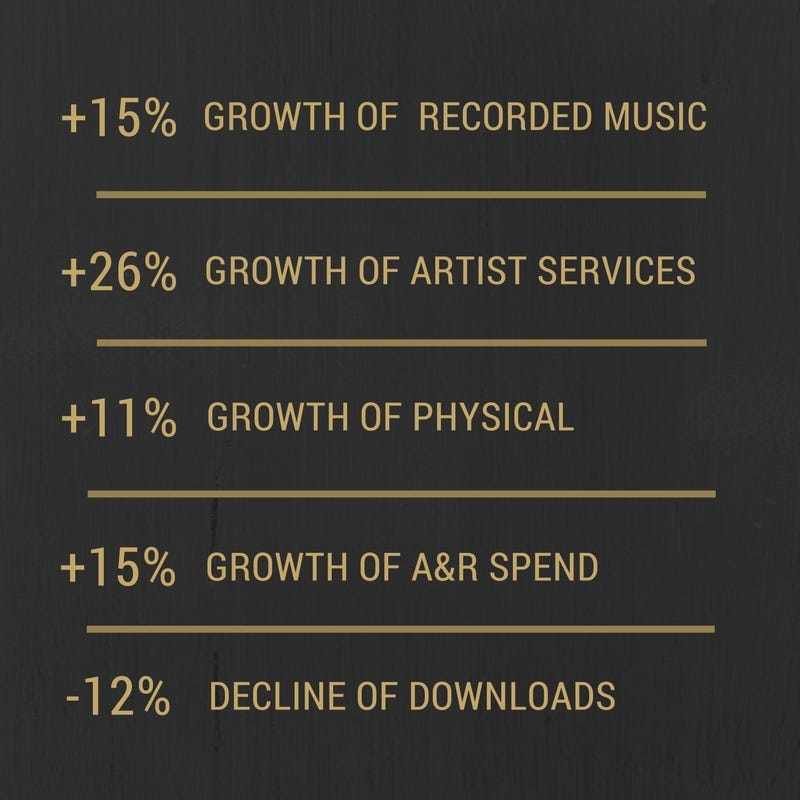

If you have a rather well rounded idea of what your investment pitch is, this is the place for it to be heard. The story builder tells us what your elevator pitch is, what musicians you compare yourself to, and your recent growth.

This is where your personality can really shine through. Tell us about who you are, and what makes you not only special, but a notable investment opportunity.

Do’s and Don’t to help you get funding - A Summary:

- Do have a plan/budget in place for what you need funding. Get down to the details.

- Don’t email us daily saying “When do I get paid?”. This isn't a charity or a blind pool of free money. Getting funding is a process and can take some time to execute fully.

- Do work with us: answer our emails, don’t disappear for weeks at a time, provide verification for your claims.

- Do let us know If there’s a pivotal change in the story line. If you didn’t have a team on board before, but have just begun working with a world class agent or manager - let's update your proposal and make sure we know to get the message out.

- Do fill out the diligence form and the business plan once you register a deal.

- Don’t not register a deal, and then ask us if we can find an investor. Investors are looking to make well-educated and researched decisions. Let's give them enough ammo.

- Do annotate anything on the business plan that might not make sense to a brand new reader

- Do have valid reasons to back up your business plan estimates.

Of course, at the end of the day this is just an overview and surely more simple than the intricacies of getting a deal fully funded, but we hope that this post has been able to shed some light on our process and methods of thinking. If you have any other questions or comments, feel free to drop us a line at info@livamp.com.

Get started at www.livamp.com/funding